Borrow against home equity calculator

Its considered a second mortgage since its attached to a home already secured by a first mortgageThe term second mortgage refers to the fact that the second mortgage lender is repaid after the first mortgage lender in a foreclosure. Why you should skip it.

Can You Use Home Equity To Invest Lendingtree

Find out how much you can afford to borrow with NerdWallets mortgage calculator.

. Call 408-451-9111 or 800-553-0880 or see our current rates. To view Home Equity Loan rates visit our Home Equity Loans. A Beginners Guide.

Building a space that is designed to meet your needs and embodies your taste requires planning and resources. Home equity loans and HELOCs have their benefits such as. The most a lender might offer you on a home equity loan in this case is 93500 or 85 of your 110000 home equity.

What is a home equity loan. Learn more about the Home Equity Loan process with PNC Home Lending whether you need cash for remodeling. It is a revolving line of credit.

Youll need enough equity to borrow against a good credit history and proof of a steady income. However it differs in a few key ways. But that still depends on your credit history and income.

This would mean that if a lender has a max LTV of 80 a borrower could borrow up to an additional 25 of the value of the home 50000 via either a home equity loan or a home equity line of credit. Rate and payment shown above are based on current offered rates. Withdraw what you need over time.

Home equity is the value of the homeowners interest in their home. As a rule of thumb lenders will generally. Home Equity Line of Credit HELOC Calculator 2022.

Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage. Documents Required for a Home Loan Having a home to call your own is a huge life achievement and a matter of immense pride. Where home price trends are strong and the borrower has an excellent credit rating some lenders may allow borrowers to access up to 90 of a home.

Home equity line of credit HELOC Like a home equity loan a HELOC uses your homes equity as collateral. Largely due to a dramatic rise in home prices the last couple of years American homeowners have never had more equity to borrow against. Homeowners Have More Equity Than Ever.

You can obtain a home equity loan using your home equity as security generally without paying. If you borrow 20000 against your home equity youll wind up paying back more than 20000. This Home Equity Available Credit calculator will help you estimate how much you may be able to borrow against your home equity.

We absorb all costs associated with establishing your loan which generally. In other words it is the real propertys current market value less any liens that are attached to that property. WOWA Trusted and Transparent.

A home equity line of credit or HELOC allows you to borrow against the equity of your home at a low cost. A home equity loan is a type of mortgage that allows you to borrow money against your homes equity. A home equity line of credit HELOC allows you to borrow against the equity in your homeAs with a credit card you draw from and repay an available line of credit usually at variable interest rates.

Unlike credit cards HELOCs typically have a fixed draw period often five to 10 years after which time the line of credit is closed and any remaining balance must be paid. HDFC Bank recognises the importance of buying your own home and offers Home Loans to help you achieve this mile. Somewhat like with a credit card you use money from the HELOC as needed then.

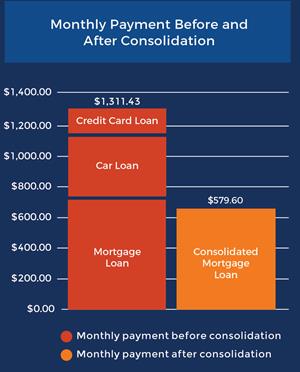

This Pages Content Was Last Updated. Credit Card Interest Calculator. Home equity can be a useful tool when you need a large sum for home improvement debt consolidation or any other purpose.

Using home equity to pay for college expenses can be a good low-interest option if you find better rates than with student loans. Few if any lenders these days will allow you to borrow against the full amount of your home equity although that was common during the pre-crash days. ATTOM a real.

A home equity loan is a lump sum of money that you borrow against the equity in your home. Unlike a mortgage or home loan its a flexible line of credit and you can use it only when. Equity is the difference between the market value of your home and what you owe on any loans secured by the home such as a mortgage loan.

The lender may only approve you for a 60000 home equity loan if your credit score isnt the highest and other factors are against you. Instead of borrowing a set amount upfront a HELOC allows you to borrow against the equity in your home on an as-needed basis. Why use home equity for this.

A home equity line of credit or HELOC is a type of second mortgage that lets you borrow against your home equity. The accuracy of this calculator is not guaranteed by any party and is intended for educational purposes only. To apply for a Home Equity Loan submit an online application Opens a new window.

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Calculator Calculate Available Home Equity Wowa Ca

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

How To Calculate Equity In Your Home Nextadvisor With Time

Home Equity Calculator Free Home Equity Loan Calculator For Excel

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Calculator Free Home Equity Loan Calculator For Excel

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Heloc Calculator

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Loan Calculator Nerdwallet

Home Equity Line Of Credit Qualification Calculator

Home Equity Guide Borrowing Basics Third Federal

Home Equity Calculator Free Home Equity Loan Calculator For Excel